- test :

Contents

Profits and losses on a futures contract are realised and paid out at the end of each day. The ongoing settlement structure is beneficial to traders with the goal of generating normalised cash flows. It is the proverbial „double-edged sword” as it boosts profit potential while simultaneously increasing risk. Highly leveraged positions are greatly impacted by any move in market price; the effect is exponentially reduced for modestly leveraged positions. Volatility is the magnitude of asset pricing fluctuations over time.

Derivatives furnish traders with consistent volatility, which can generate attractive trade setups. When coupled with enhanced leverage, financial derivatives are useful in hedging and speculative strategies. However it is also important to understand when to flatten your position when trading futures contracts.

1) To be a minimum point, the graph must change direction from decreasing to increasing. Each company is unique, and you should analyze your hedging needs with your FX provider. With EDC’s FXG, you can secure FX contracts without providing collateral, making financial institutions more confident in lending you money against those assets. By submitting this form, I consent to receive EDC’s e-newsletters, trade information and promotional messages, and can withdraw consent at any time.

Doing nothing is the real risk

However FX futures unlike regular futures are not traded on a centralized exchange. Instead deal flow is available through many different exchanges globally,with the vast majority of FX futures traded through the CME exchange. vintage fx Higgins points to a major food manufacturer that sells its products in U.S. dollars. The company previously used basic ‘vanilla’ forwards contracts, to gain certainty of the exchange rate received for their sales.

The reason for this is that the FX futures market is highly volatile and so it is even more important to only take a minimum calculated risk by creating and following a focused investment strategy. Moreover while 0.45% change might not seem significant on the surface, the fact that a single CDU7 contract itself costs CAD 10,000 means that even smaller price fluctuations can have a significant monetary impact. As awareness of currency risk grows, more companies are turning to Scotiabank’s FX Specialists, in ig group review light of the Bank’s commitment to serve mid-sized companies, with the same calibre of expertise and services availed to Fortune 500 firms. They can access the Bank’s entire breadth of services and resources, while working with a solid, dependable major financial institution that will be there in changing market and business conditions. C) Find the zeros of the original function by using your graphing calculator. The method of implicit differentiationallows us to find the derivative of an implicit function.

Friedberg Direct Policies

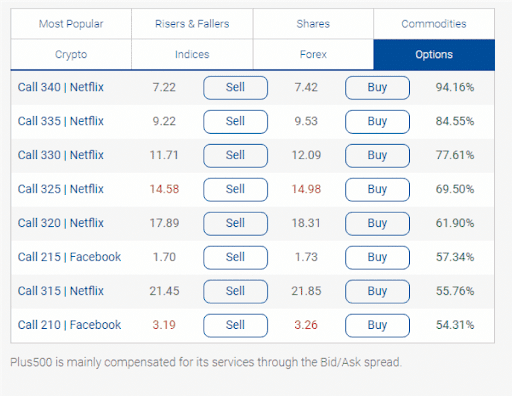

A currency option gives an investor the right, but not the obligation, to buy or sell a quantity of currency at a pre-established price on or before the date that the option expires. The right to sell a currency is known as a „call option” and the right to buy is known as a „put option.” Although derivatives leverage may appear attractive, it is best applied prudently within the framework of a comprehensive trading plan. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period.

Higher-order derivatives are important to check the concavity of a function, to confirm whether an extreme point of a function is max or min, etc. E) Now take the limit as x goes to both infinities of the original function. 2) To be a maximum point, the graph must change direction from increasing to decreasing.

The period is based on the time for the transaction to clear in the accounts of the respective participants in the trade. Currencies, however, are commonly traded as part of derivative contracts in futures, forwards, options and swaps. Within the fields of trading and finance, a derivative is considered to be an instrument used for investment via a contract. Common types of derivative contracts include options, forwards, futures and swaps. As a Canadian company, if you sell goods and services internationally and get paid in a foreign currency, there’s a risk that exchange rates could change and you’ll receive less CAD than originally expected. The reverse holds true if you are purchasing products in a foreign currency, with the risk that you will have to pay more.

If a function is differentiable at a then it is also continuous at a. The contrapositive of this theorem states that if a function is discontinuous at a then it is not differentiable at a. Where \(p\) denotes the unit price in dollars and \(q\) denotes the quantity demanded. This means that after 6 months—2 months after the introduction of the drug—the rate at which number of infected individuals was increasing starts to decrease. Sketch the graph of \(f\) and the tangent line to the curve at the point found in part . Determine the point on the graph of \(f\) where the tangent line to the curve is horizontal.

D Hints for Exercises

Acceleration is the derivative of the velocity function and the second derivative of the position function. Determine \(I”\) from \(I’\) using the definition of the derivative. In Chapter 5 we will discuss applications etoro review such as curve sketching involving the geometric interpretation of the second derivative of a function. The following examples provide an interpretation of both the first and the second derivative in familiar roles.

- The largest such vendor is the Chicago Mercantile Exchange , which offers a lineup of FX futures contracts.

- Partial derivatives have numerous applications, as for example in physics and engineering; wave equations are among such important examples of the use of partial derivatives in physics and engineering.

- Institutional investors such as banks, pension funds and insurance companies often purchase CDS contracts to hedge counterparty risk exposure.

- Environment and Climate Change Canada says Teck Metals, a subsidiary of Teck Resources, has been ordered to pay $2.2 million in federal and provincial fines for an effluent spill into the Columbia River.

- Since you expect the contract price to rise, you would purchase CDU7 futures contract and take a long position in anticipation of that potential rise.

We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests. Since the derivative f′ of f is also a function x, higher derivatives can be obtained by applying the same procedure to f′ and so on. What characterizes a straight line is the fact that it has constant “slope”. The first order partial derivative with respect to the variable \(\color\) is \(\color\).

Any foreign currency exposures are captured in end of day revaluation procedures of the balance sheet. FxOffice can maintain separate income ledger accounts for realized, unrealized and revaluation gains and losses while further splitting derivative and non-derivative related accounts. The derivatives of the six trigonometric functions are shown below. Taking limits to find the derivative of a function can be very tedious and complicated.

Use Of Derivatives In Forex Trading

Conversely, standardised exchanges such as the NYSE, CME, or Euronext record the exact number of traded futures and options contracts. And, while our fluctuating dollar impacts every company doing business outside of Canada, few mid-sized businesses have a plan to manage their foreign exchange ‘FX’ risk. Fortunately, Scotiabank makes hedging strategies accessible to Commercial Banking clients, to manage their foreign exchange exposure while selling bread, making widgets or lacing their skates in distant markets. Derivatives are often used by large institutions to hedge business risks. But some derivatives, such as foreign exchange contracts or contracts for difference, are used by smaller market participants for both hedging and speculation. Check out our free guide to learn about the most effective FX hedging instruments, useful resources, and mechanisms, like EDC’s FXG, to make sure you’re getting the most out of your FX hedging strategy without locking up your working capital.

The definition of derivatives also gives the BCSC flexibility to ensure that we can apply the appropriate regulatory regime to the instrument we regulate. Under the Securities Act, the British Columbia Securities Commission has jurisdiction over derivatives markets in the province. Earlier in the derivatives tutorial, we saw that the derivative of a differentiable function is a function itself. If the derivative f’ is differentiable, we can take the derivative of it as well. If we continue to take the derivative of a function, we can find several higher derivatives. The profit increases as production increases, peaking at \(7500\) units.

Although similar, American and European options contracts have one primary difference. American options may be exercised at any time ahead of expiry; European options can only be exercised on the contract’s expiration date. Pragmatically, a CDS is a contract where one party pays a premium over time to secure a payout in the event of a counterparty debt default.

YOUR COMMENT